Apple released the iPhone 16e, last week. Like the SE before it, the 16e is the cheapest iPhone currently on offer, which isn't quite the same thing as saying it's cheap: it's selling for $599 in the states. So it will be interesting to see how it performs globally.

To get some idea of how it might fare, the team at Zedge has looked back at the last two major iPhone releases to gauge how quickly they penetrated our user base of roughly 30 million MAU.

iPhones are a dominant device in the US market, but Zedge’s global footprint provides a unique view into how Apple hardware rolls out in both developed and emerging markets.

India, and the explosive growth of the last model

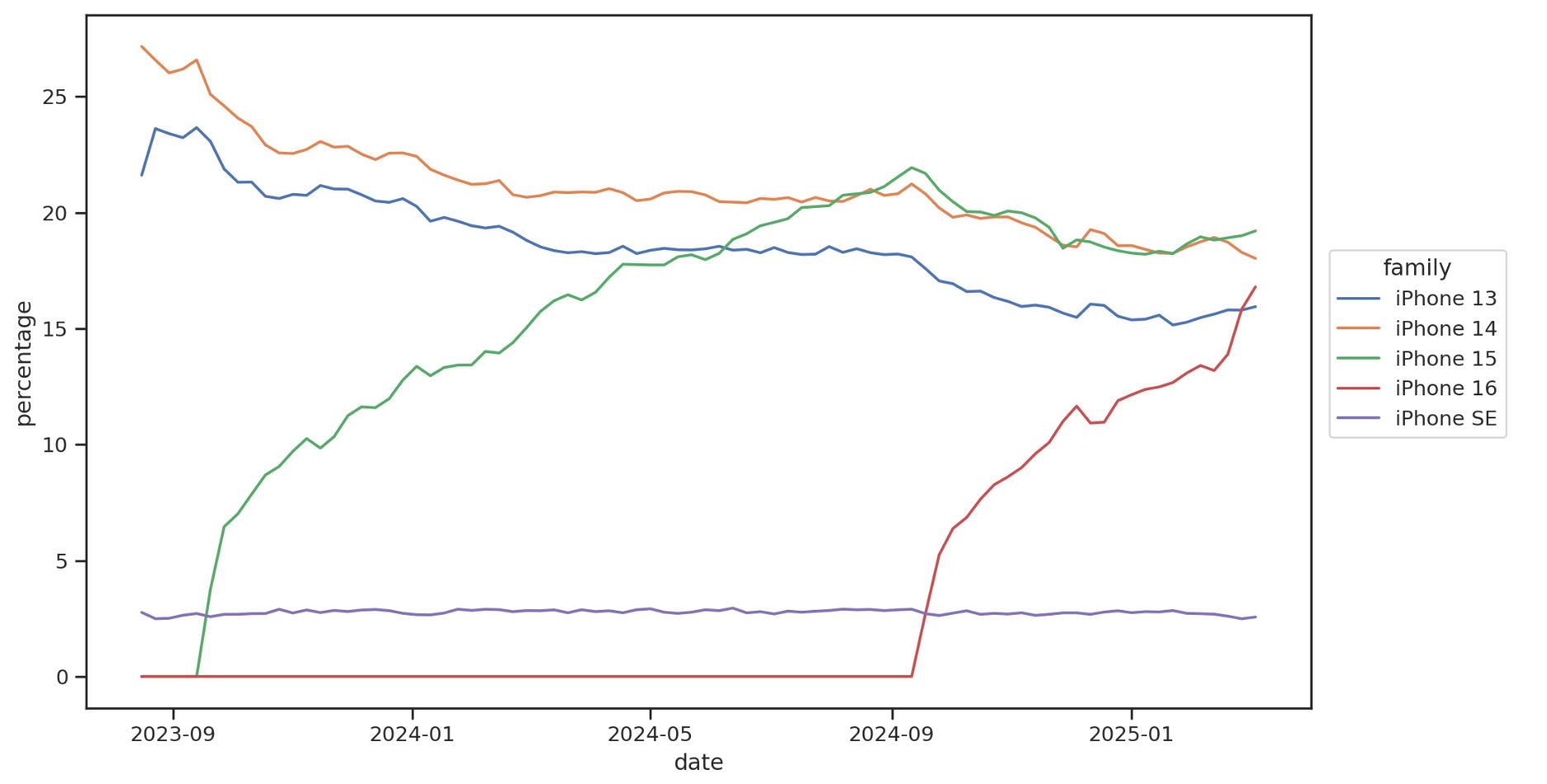

Consider this chart showing the percentage of our daily active users on different iOS devices over time in the US. The blue line shows the iPhone 13, gently declining from September 2023 onwards. In that same month, the iPhone 15 (green line) launches. We see the iPhone 16 models, represented by the red line, appear a year later. The iPhone SE chugs along with a low but very steady presence.

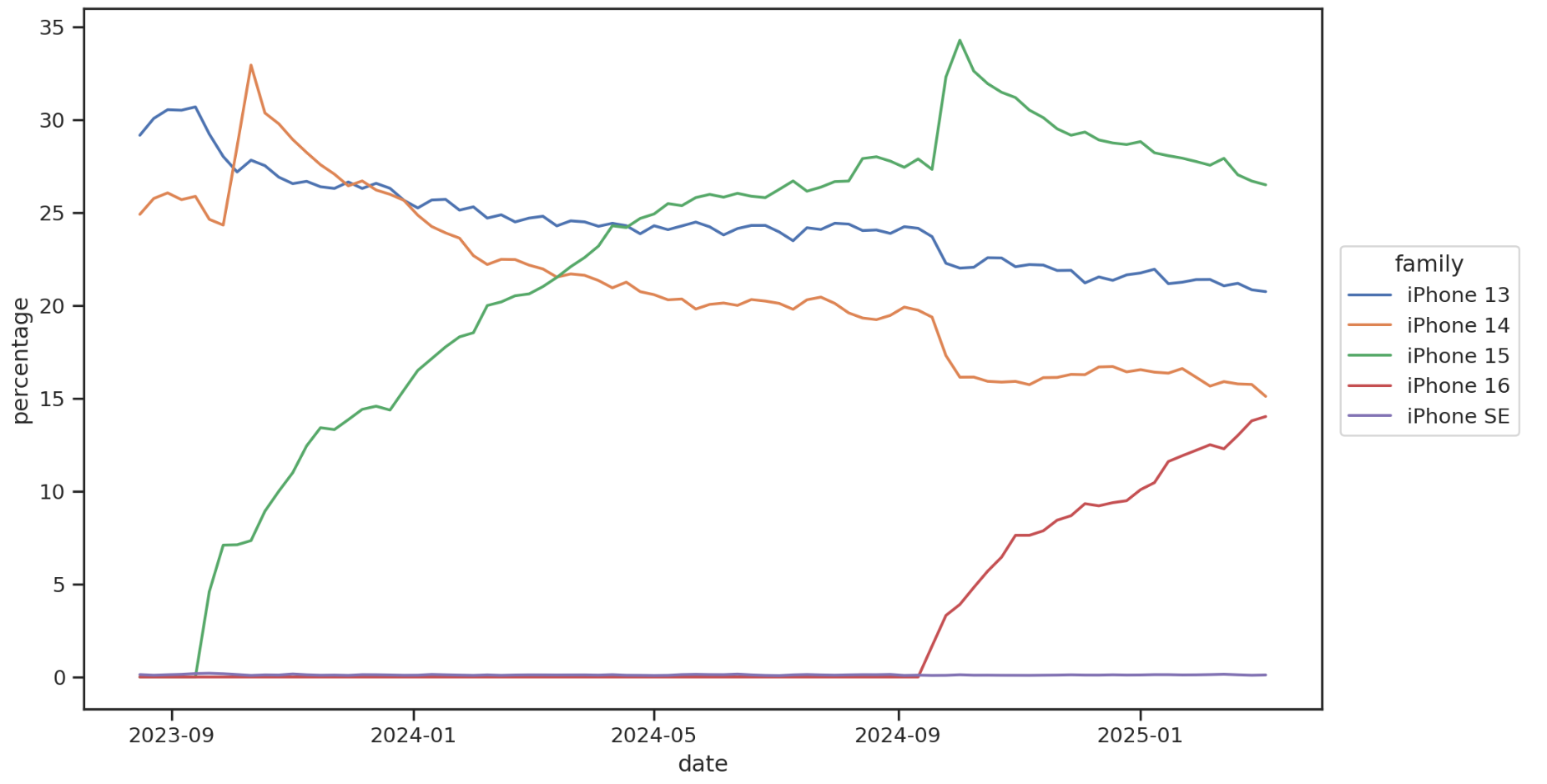

But now look at the same chart for India. For one, India has virtually no iPhone SE presence in our data. The SE was a strategic play to capture customers who needed a more affordable phone, but our data at least suggests the India market doesn’t buy Apple phones the same way.

This chart also provides a more striking observation: in India, when new models launch, sales of the OLDER model seem to spike. The launch of the iPhone 15 kicks off a far greater spike in iPhone 14 models, then a year later, the launch of the 16 does the same to the 15. Apple has pursued a unique and aggressive strategy in the Indian market, emphasizing payment plans and, more recently, some hard cash discounts – our data suggests those tactics are driving some very distinctive behavior.

Launch Velocity

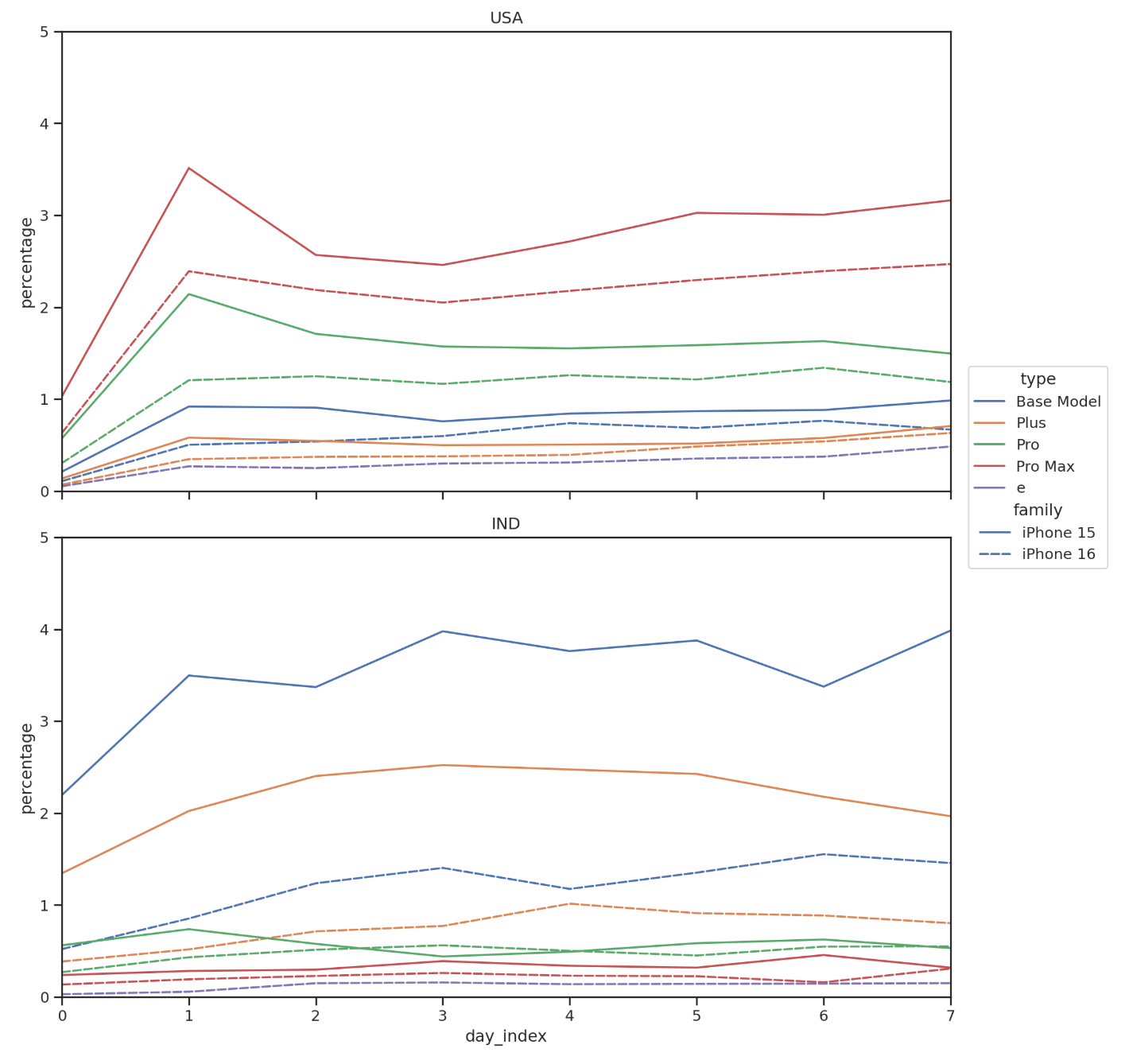

The charts we've already looked at show us different launches over the years, but what do those launches look like side by side? We’ve got a few years of history here, and looking at the data indexed to launch day, we get a pretty clear picture of how each type of iPhone performed in their first 150 days post-launch.

From our data it certainly looks like India is the land of the iPhone 15 Base model, and nothing has touched that model's launch performance since. In the USA, all the excitement seems to be for the top-of-the-line Pro Max models, with 15 just outperforming the newer 16 Pro Max.

There's also a story to be told about relative launch performance between these device generations. Across the board, you can see that, color for color, the dotted line is below, or just in line with, the solid lines. That suggests that "launch heat" for gen 16 has declined, or at best, barely kept up with gen 15.

First Week Enthusiasm for the 16e

A wider slowdown in sales – in regions as diverse as the USA and India – was almost certainly on Apple’s mind when they worked out their strategy for the new 16e. So one might wonder… how is that going?

The dotted purple line across the bottom of these charts represents our first few days of data on the 16e, and at least among Zedge’s user base, this is very clearly the weakest launch for an iPhone, of any variant, in our observation window.

Where to from here?

As the 16e launch plays out, it looks like this new device might have a hard time unseating what look like its main competitors – in India, the last flagship model, and in the USA, the Pro Max variants.

For us at Zedge, we're keen to explore further – do sales of last-generation models also spike for flagship Android phones? Why do we see so little of the iPhone SE in India, when that model was aimed directly at that market?

There are also insights to be gained about device decline: given persistent rumors that older generation iPhones get "killed off" when newer generations arrive, can we see a precipitous decline in an older generation model, closely correlated with the release of a new one?

We'll continue analyzing such data, and sharing the results as we do.